Evolving Role of Mortgage and Home Finance Consultant in 2026

In 2026, the role of the Mortgage and Home Finance Consultant will evolve significantly, integrating advanced AI-driven analytics and personalized financial solutions. The introduction of blockchain technology will enhance transparency and security in transactions, making consultants pivotal in guiding clients through complex mortgage products. A TrueCV-optimized resume will highlight your adaptability to these changes, ensuring alignment with emerging industry standards.

As client expectations shift towards more personalized and tech-savvy solutions, consultants will need to demonstrate a deep understanding of these innovations.

Why Employers are Increasing Demand for This Role in 2026

The demand for Mortgage and Home Finance Consultants is surging in 2026 due to a booming real estate market and regulatory changes aimed at enhancing consumer protection. The UAE's investment in smart city initiatives and digital transformation is driving the need for financial professionals who can navigate new compliance standards and leverage technology effectively.

- Adoption of AI and blockchain in financial transactions

Get your resume tailored to highlight your mortgage consulting skills for 2026.

Build My Mortgage and Home Finance Consultant ResumeEvolving Responsibilities of Mortgage and Home Finance Consultants

As technology reshapes the financial landscape, the responsibilities of Mortgage and Home Finance Consultants will expand to include data analysis and strategic financial planning. Consultants will be expected to utilize advanced software tools to provide clients with tailored mortgage solutions, ensuring they meet the evolving regulatory requirements.

- Incorporating data-driven insights into client consultations

Emerging Skills and Tools for 2026 Mortgage Consultants

In 2026, key skills for Mortgage and Home Finance Consultants will include proficiency in AI analytics, blockchain technology, and advanced customer relationship management (CRM) systems. Familiarity with new compliance frameworks will also be essential as regulations evolve.

- Expertise in AI-driven financial modeling tools

Align your resume with the latest mortgage industry keywords for 2026.

Create My Mortgage and Home Finance Consultant ResumeNew Qualifications and Certifications for 2026

As the industry adapts to new technologies and regulations, certifications in blockchain finance and AI in finance will become increasingly valuable. Professionals will need to stay updated with the latest compliance standards to remain competitive in the job market.

- Certification in Blockchain for Finance

Salary Growth Trends for Mortgage Consultants in 2026

With the increasing complexity of financial products and heightened demand for expertise, salaries for Mortgage and Home Finance Consultants are expected to rise significantly in 2026. The combination of technological proficiency and regulatory knowledge will be key drivers of this growth.

- Increased compensation due to demand for specialized skills

Career Stability and Visa Opportunities in 2026

The UAE's commitment to becoming a global financial hub will enhance career stability for Mortgage and Home Finance Consultants. The demand for skilled professionals is expected to remain strong, providing ample opportunities for long-term employment and visa sponsorship.

- Stable hiring trends in the financial sector

Top Employers Hiring Mortgage Consultants in 2026

Leading financial institutions such as Emirates NBD, Abu Dhabi Commercial Bank, and Dubai Islamic Bank are ramping up hiring for Mortgage and Home Finance Consultants in 2026. These employers are seeking professionals who can navigate the complexities of new technologies and regulatory landscapes.

- Emirates NBD - expanding mortgage services

- Abu Dhabi Commercial Bank - enhancing customer experience

- Dubai Islamic Bank - focusing on innovative financial solutions

Steps to Secure a Mortgage Consultant Role in 2026

- Enhance your skills in AI and blockchain technologies.

- Align your resume with industry-specific keywords using TrueCV.

- Develop a targeted application strategy focusing on top employers.

How TrueCV Enhances Your Job Application

- Tailored intake process to identify your unique skills.

- Mapping of keywords to align with 2026 hiring expectations.

- Continuous iteration and optimization of your resume for maximum impact.

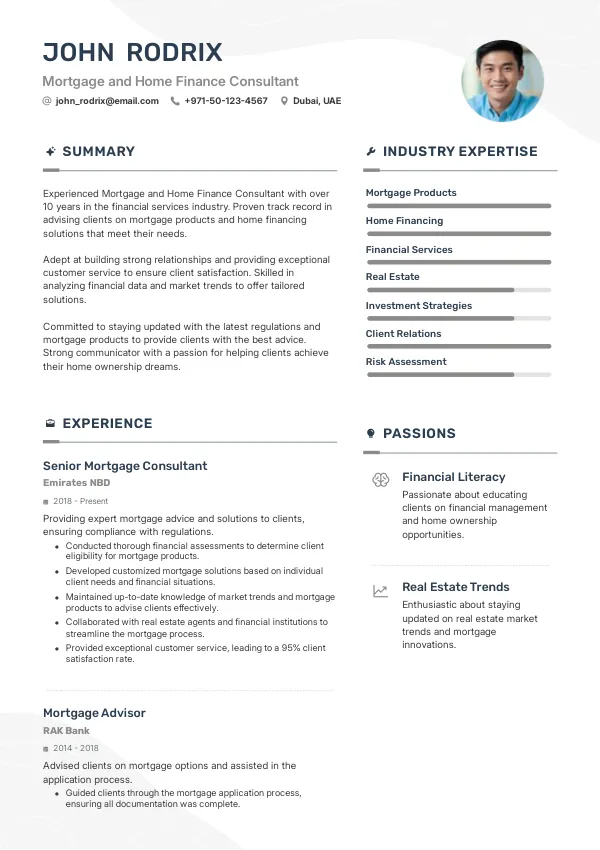

Resume Examples for Mortgage and Home Finance Consultants

- Achievement: Successfully implemented AI-driven financial solutions, increasing client satisfaction by 30%.

Frequently Asked Questions

What skills will be in high demand for Mortgage Consultants in 2026?

In 2026, skills in AI analytics, blockchain technology, and advanced compliance knowledge will be crucial.

How is the job market for Mortgage Consultants expected to change in 2026?

The job market is expected to see significant growth due to increased demand for personalized financial solutions.

What certifications should I pursue to enhance my career as a Mortgage Consultant in 2026?

Certifications in blockchain finance and AI in finance will be highly regarded in 2026.

How can I improve my chances of getting hired as a Mortgage Consultant in 2026?

Aligning your resume with the latest industry expectations using TrueCV will greatly enhance your chances.

What salary growth can Mortgage Consultants expect in 2026?

Salary growth is expected to be substantial, driven by the demand for specialized skills and expertise.

Seize the Opportunity in 2026 as a Mortgage and Home Finance Consultant

Position yourself for success in the evolving landscape of personal finance. A TrueCV-optimized resume will ensure you stand out in the competitive job market of 2026.