Evolving Role of Financial Advisory Consultant in 2026

In 2026, the Financial Advisory Consultant role is set to evolve significantly, driven by advancements in AI-driven analytics and blockchain technology. These innovations will reshape how consultants deliver insights and manage client portfolios, requiring a more tech-savvy approach. A TrueCV-optimized resume can help highlight your adaptability to these changes, showcasing your readiness for this dynamic role.

As client expectations shift towards more personalized and data-driven advice, the role will demand a deeper understanding of financial technologies and regulatory frameworks.

Why Financial Advisory Consultants Are in Demand in 2026

The demand for Financial Advisory Consultants in 2026 is surging due to the increasing complexity of financial regulations and the need for strategic financial planning in a post-pandemic economy. The adoption of AI tools for predictive analytics and enhanced client engagement platforms will drive this demand.

- New regulations around financial transparency and data privacy will require consultants to be well-versed in compliance standards.

Enhance your resume to align with the evolving role of Financial Advisory Consultant in 2026.

Build My Financial Advisory Consultant ResumeEvolving Responsibilities for Financial Advisory Consultants

As technology continues to advance, Financial Advisory Consultants will take on expanded responsibilities, including utilizing AI for financial forecasting and employing blockchain for secure transactions. This evolution will necessitate a shift towards more strategic advisory roles rather than traditional transactional tasks.

- Consultants will need to integrate technology into their advisory processes to enhance client service.

Essential Skills and Tools for 2026

In 2026, Financial Advisory Consultants will need to master new tools such as advanced financial modeling software and regulatory compliance platforms. Skills in data analytics, AI utilization, and blockchain technology will become essential.

- Proficiency in these tools will not only enhance service delivery but also improve client trust and satisfaction.

Showcase your skills and experiences effectively for Financial Advisory Consultant roles in 2026.

Create My Financial Advisory Consultant ResumeNew Qualifications and Certifications in 2026

As the financial landscape evolves, certifications in fintech and regulatory compliance will gain prominence. Consultants may need to pursue new qualifications such as Certified Financial Technology Professional (CFTP) to remain competitive.

- These certifications will reflect a commitment to staying current with industry standards and technological advancements.

Salary Growth for Financial Advisory Consultants in 2026

The complexity of financial advisory roles in 2026 is expected to drive salary growth, with top consultants earning significantly more as they leverage advanced technologies to provide superior client service. The demand for specialized skills will also contribute to higher compensation packages.

- Increased demand for tech-savvy consultants will be a key growth lever in salary negotiations.

Career Stability and Visa Opportunities in 2026

The UAE's growing economy and investment in financial technologies will create stable job opportunities for Financial Advisory Consultants. The demand for skilled professionals will support visa applications, making it easier for international talent to enter the market.

- Employers will prioritize candidates with a strong understanding of local regulations and market dynamics.

Top Employers Hiring Financial Advisory Consultants in 2026

Leading firms such as Deloitte, PwC, and EY are expected to ramp up hiring for Financial Advisory Consultants in 2026, driven by the need for expertise in navigating complex financial landscapes.

- These firms will seek consultants who can leverage technology to enhance client engagement and compliance.

Steps to Secure a Financial Advisory Consultant Role

- Enhance your skills in financial technologies and compliance.

- Align your resume with the evolving role expectations using TrueCV.

- Develop a strategic application approach targeting top employers.

How TrueCV Can Enhance Your Job Search

- TrueCV provides role-specific intake to tailor your resume effectively.

- Keyword and expectation mapping ensures alignment with 2026 hiring trends.

- Continuous iteration and optimization of your resume improve your chances of standing out.

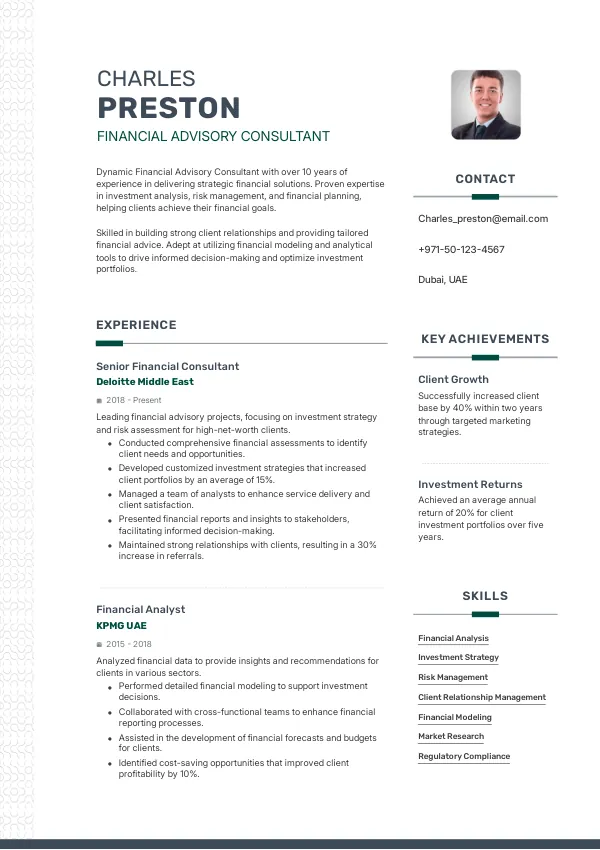

Resume Examples for Financial Advisory Consultants

- Achievement: Demonstrated expertise in AI-driven financial analysis, aligning with future role expectations.

Frequently Asked Questions

What are the hiring trends for Financial Advisory Consultants in 2026?

In 2026, there will be a significant increase in demand for Financial Advisory Consultants due to the complexity of financial regulations and the integration of technology in financial services.

What skills will be most important for Financial Advisory Consultants in 2026?

Key skills will include proficiency in AI tools, data analytics, and understanding of blockchain technology, which are essential for modern financial advisory roles.

How does the salary for Financial Advisory Consultants change in 2026?

Salary growth is expected as demand for tech-savvy consultants increases, with top professionals earning significantly more due to their specialized skills.

What certifications should I pursue as a Financial Advisory Consultant in 2026?

Certifications in fintech and regulatory compliance, such as Certified Financial Technology Professional (CFTP), will be highly valued in 2026.

What are the top employers looking for in Financial Advisory Consultants in 2026?

Top employers will seek candidates who can leverage technology for enhanced client engagement and compliance, particularly in firms like Deloitte, PwC, and EY.

Seize the Opportunity in 2026 as a Financial Advisory Consultant

As the financial landscape evolves, ensure your resume reflects the skills and experiences that align with 2026 expectations. A TrueCV-optimized resume can significantly enhance your job search outcomes.