Role Overview for Credit Risk Analysts in 2026

The role of a Credit Risk Analyst is evolving in 2026, driven by advancements in AI and machine learning technologies that enhance risk assessment capabilities. This evolution requires professionals to adapt to new analytical tools and frameworks, positioning them as critical assets in financial decision-making. As a result, candidates with well-crafted resumes that highlight their seniority and contributions will be better perceived for long-term residency options, including the Golden Visa.

In 2026, the demand for skilled Credit Risk Analysts is expected to surge, making this an opportune time for professionals seeking to align their careers with Golden Visa pathways.

Why This Role is Critical in 2026

The financial landscape is experiencing a significant shift in 2026 due to regulatory changes and increased investment in risk management technologies. These factors are driving the demand for Credit Risk Analysts who can navigate complex financial environments and provide insights that mitigate risks. This role is increasingly seen as vital for maintaining economic stability, thus enhancing its alignment with long-term residency and Golden Visa considerations.

- Emerging AI-driven analytics platforms that enhance risk evaluation and reporting.

Get your resume ready to highlight your seniority and impact for long-term residency alignment.

Build My Credit Risk Analyst ResumeEvolving Responsibilities of Credit Risk Analysts in 2026

In 2026, Credit Risk Analysts will take on more strategic responsibilities, utilizing advanced data analytics to inform business decisions. This shift not only signals a higher level of seniority but also underscores the economic contributions of these professionals to their organizations. A well-positioned resume that reflects these evolving responsibilities will be essential for candidates aiming for long-term residency options, including the Golden Visa.

- Integration of predictive analytics into risk assessment processes.

Essential Skills and Tools for 2026

As the role of Credit Risk Analysts evolves, so do the required skills and tools. In 2026, proficiency in AI-based risk modeling and data visualization tools will be crucial. These skills not only enhance a candidate's employability but also strengthen their alignment with Golden Visa eligibility perceptions, as they demonstrate a commitment to contributing to the UAE's economic landscape.

- Familiarity with advanced risk management software and machine learning algorithms.

Align your ATS keywords with 2026 expectations and enhance your Golden Visa relevance.

Create My Credit Risk Analyst ResumeQualifications and Certifications for 2026

In 2026, obtaining certifications in financial risk management and data analytics will be increasingly important. These credentials not only enhance a candidate's credibility but also signal their readiness for senior roles, which are often viewed favorably in the context of Golden Visa applications. A resume that highlights these qualifications will be vital for candidates looking to establish long-term residency in the UAE.

- Certification in Financial Risk Management (FRM) or similar.

Salary and Growth Prospects in 2026

The compensation for Credit Risk Analysts is projected to increase in 2026 due to heightened demand and the complexity of the role. This growth in salary not only reflects the value of the position but also aligns with long-term residency considerations, as higher earnings can support Golden Visa eligibility perceptions. A resume that effectively communicates these financial achievements will be crucial for candidates.

- Increased salary ranges driven by demand for specialized skills.

Visa and Career Stability in 2026

In 2026, the employability of Credit Risk Analysts is expected to remain strong, driven by ongoing market needs and the critical nature of their work. This stability is often viewed favorably in the context of long-term residency and Golden Visa applications, making it essential for candidates to position their resumes to reflect this stability and their contributions to the financial sector.

- Consistent hiring trends in the financial services sector.

Top Employers for Credit Risk Analysts in 2026

Leading financial institutions such as Emirates NBD, Abu Dhabi Commercial Bank, and First Abu Dhabi Bank are expected to ramp up hiring for Credit Risk Analysts in 2026. These employers value senior roles that contribute significantly to their risk management strategies, which supports candidates' long-term residency aspirations, including Golden Visa considerations.

- Emirates NBD - expanding risk management teams to enhance financial resilience.

- Abu Dhabi Commercial Bank - investing in advanced analytics for risk assessment.

- First Abu Dhabi Bank - focusing on strategic risk management initiatives.

How to Secure a Credit Risk Analyst Role in 2026

- Enhance your skills in AI and data analytics relevant to risk management.

- Align your resume to highlight seniority and contributions that resonate with Golden Visa pathways.

- Develop a targeted application strategy that emphasizes your economic impact.

How TrueCV Can Assist You

- Understand the evolving expectations for Credit Risk Analysts in 2026.

- Map your skills and experiences to relevant ATS keywords that signal seniority.

- Position your resume to align with Golden Visa evaluation perceptions, enhancing your long-term residency prospects.

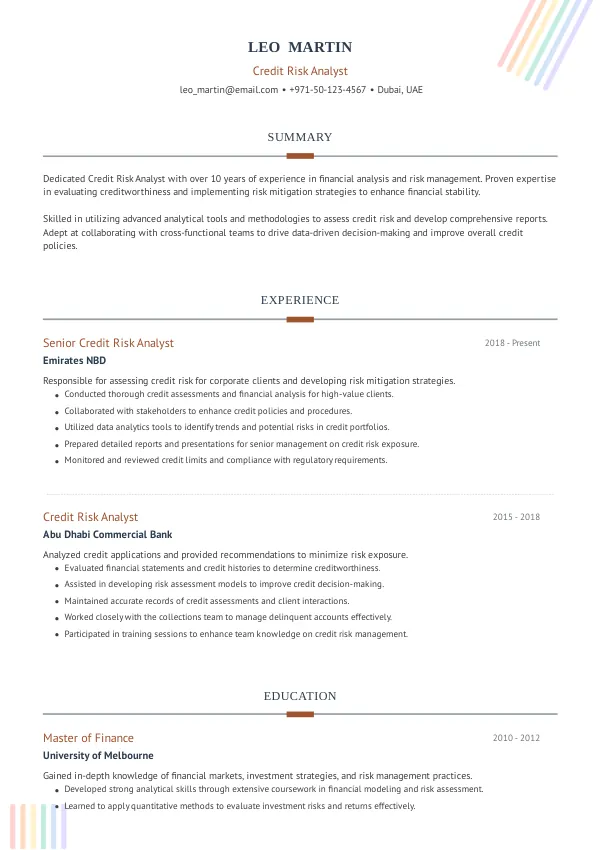

Resume Examples for Credit Risk Analysts

- Achievement: Developed a predictive risk model that reduced loan default rates by 15%, demonstrating significant economic contribution and aligning with long-term residency considerations, including Golden Visa pathways.

Frequently Asked Questions

What are the key skills needed for Credit Risk Analysts in 2026?

In 2026, skills in AI and data analytics are crucial for Credit Risk Analysts, enhancing their employability and supporting Golden Visa eligibility perceptions.

How is the demand for Credit Risk Analysts changing in 2026?

The demand is increasing due to regulatory changes and the need for advanced risk management, which aligns with long-term residency options like the Golden Visa.

What is the expected salary growth for Credit Risk Analysts in 2026?

Salary growth is anticipated due to the complexity of the role, which often supports perceptions of stability for Golden Visa applications.

What certifications should I pursue as a Credit Risk Analyst in 2026?

Certifications like FRM will be valuable in 2026, enhancing your credibility and aligning with Golden Visa considerations.

What is the career outlook for Credit Risk Analysts in 2026?

The career outlook is strong, with consistent hiring trends that support long-term residency options, including the Golden Visa.

Take the Next Step in Your Career

Position yourself for success as a Credit Risk Analyst in 2026 with a resume that highlights your seniority and economic contributions, enhancing your prospects for long-term residency and Golden Visa opportunities.