Evolving Role of Compliance Officer in 2026

In 2026, the role of Compliance Officer in Islamic Finance is set to evolve significantly, driven by new regulatory frameworks and technological advancements. The integration of AI-driven compliance tools will redefine traditional responsibilities, emphasizing the need for strategic oversight in ensuring Sharia compliance.

As the market adapts, candidates must align their resumes with these evolving expectations, showcasing their proficiency in modern compliance technologies.

Why Compliance Officers Are in Demand in 2026

The demand for Compliance Officers in Islamic Finance is surging in 2026 due to increased regulatory scrutiny and the expansion of Islamic financial products. The introduction of new compliance standards, such as the International Financial Reporting Standards (IFRS) for Islamic Finance, is driving this need.

- Adoption of AI and machine learning for compliance monitoring

Optimize your resume for Compliance Officer roles in Islamic Finance for 2026 with TrueCV.

Build My Compliance Officer – Islamic Finance ResumeResponsibilities of Compliance Officers in 2026

In 2026, Compliance Officers will take on expanded responsibilities, including the implementation of advanced compliance technologies and data analytics to ensure adherence to Islamic finance principles. This shift requires a proactive approach to risk management and compliance strategy formulation.

- Integration of AI tools for real-time compliance monitoring

Skills and Tools for Compliance Officers in 2026

Emerging skills for Compliance Officers in 2026 will include expertise in AI-driven compliance software and a deep understanding of evolving Islamic finance regulations. Familiarity with blockchain technology for transaction transparency will also be crucial.

- Proficiency in AI compliance tools and blockchain applications

Align your skills with the evolving demands of Compliance Officers in 2026 using TrueCV.

Create My Compliance Officer – Islamic Finance ResumeQualifications and Certifications for 2026

By 2026, candidates will be expected to hold advanced certifications in compliance and Islamic finance, such as the Certified Compliance and Ethics Professional (CCEP) and the Islamic Finance Qualification (IFQ). These credentials will enhance employability in a competitive market.

- Emergence of new certifications specific to Islamic finance compliance

Salary Growth for Compliance Officers in 2026

As demand for Compliance Officers in Islamic Finance grows, salaries are expected to increase significantly. The complexity of regulatory compliance and the need for specialized skills will drive this growth, making it a lucrative career path.

- Increased salary expectations due to high demand and specialized skills

Visa and Career Stability for Compliance Officers in 2026

The UAE's commitment to becoming a global hub for Islamic finance will enhance career stability for Compliance Officers. The demand for skilled professionals in this field is expected to remain strong, providing a stable employment landscape.

- Strong governmental support for the Islamic finance sector

Top Employers Hiring Compliance Officers in 2026

Leading financial institutions in the UAE, such as Abu Dhabi Islamic Bank, Dubai Islamic Bank, and Emirates NBD, are ramping up their hiring of Compliance Officers to navigate the evolving regulatory landscape.

- Abu Dhabi Islamic Bank - expanding compliance teams to meet new regulations

- Dubai Islamic Bank - increasing focus on compliance technology

- Emirates NBD - enhancing compliance frameworks for Islamic products

How to Secure a Compliance Officer Role in 2026

- Enhance your qualifications with relevant certifications.

- Align your resume with the latest compliance technologies and expectations.

- Develop a strategic application approach targeting top employers in the Islamic finance sector.

How TrueCV Can Elevate Your Application

- Tailored resume intake focusing on compliance roles.

- Mapping keywords and expectations specific to 2026 hiring trends.

- Continuous iteration and optimization for maximum impact.

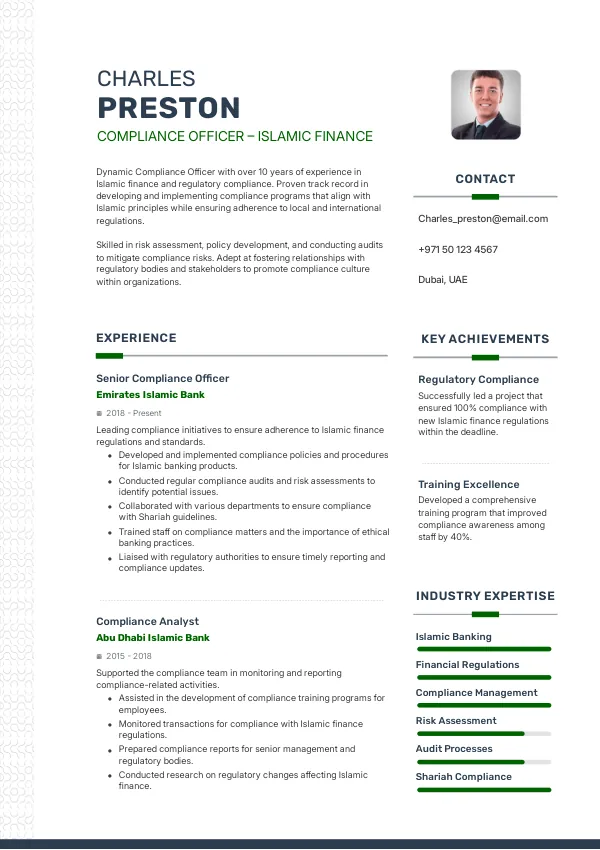

Resume Examples for Compliance Officers

- Achievement: Successfully implemented AI compliance tools, enhancing regulatory adherence by 30%.

FAQs about Compliance Officer Roles in 2026

What skills will be in demand for Compliance Officers in 2026?

In 2026, skills in AI compliance tools, data analytics, and knowledge of Islamic finance regulations will be crucial.

How is the salary outlook for Compliance Officers in 2026?

Salary growth is expected to be significant due to increased demand and the complexity of compliance roles.

What are the top employers hiring Compliance Officers in 2026?

Major banks like Abu Dhabi Islamic Bank and Dubai Islamic Bank are increasing their hiring efforts in this field.

How will the role of Compliance Officer evolve in 2026?

The role will expand to include advanced compliance technologies and a strategic focus on risk management.

What certifications should I pursue for a Compliance Officer role in 2026?

Certifications such as CCEP and IFQ will be highly valued in the job market.

Prepare for Your Future as a Compliance Officer in 2026

With the evolving landscape of Islamic finance, aligning your resume with TrueCV can significantly enhance your chances of securing a Compliance Officer role in 2026.