Evolving Role of Bilingual Credit Analyst in 2026

In 2026, the role of a Bilingual Credit Analyst will significantly evolve, incorporating advanced data analytics and AI-driven credit assessment tools. As financial institutions embrace digital transformation, the demand for analysts who can interpret data in multiple languages will be crucial. A TrueCV-optimized resume can highlight your bilingual skills and analytical prowess, aligning with these emerging expectations.

With the increasing complexity of financial products and services, the role will also expand to include cross-functional collaboration with tech teams, enhancing the overall decision-making process.

Why Employers Are Hiring Bilingual Credit Analysts in 2026

The demand for Bilingual Credit Analysts in 2026 is driven by the rapid digitalization of the finance sector in the UAE. New regulations around data privacy and compliance have emerged, necessitating skilled professionals who can navigate these complexities. Furthermore, the rise of fintech companies is creating a competitive landscape that requires bilingual analysts to cater to diverse client bases.

- Adoption of AI and machine learning in credit scoring systems

Optimize your resume for Bilingual Credit Analyst roles in 2026 with TrueCV's tailored approach.

Build My Bilingual Credit Analyst ResumeEvolving Responsibilities of Bilingual Credit Analysts

As the finance industry evolves, Bilingual Credit Analysts will take on more strategic responsibilities, including the integration of AI tools for credit risk assessment and customer insights. This shift will require analysts to not only assess creditworthiness but also to provide actionable insights based on data trends.

- Incorporation of predictive analytics into credit evaluations

Essential Skills and Tools for 2026

In 2026, proficiency in AI-driven analytics tools and financial modeling software will be paramount for Bilingual Credit Analysts. Additionally, strong communication skills in both English and Arabic will be essential to effectively engage with clients and stakeholders.

- Familiarity with platforms like Tableau and Python for data visualization

Align your skills and experiences to meet the demands of the finance industry in 2026.

Create My Bilingual Credit Analyst ResumeQualifications and Certifications for Bilingual Credit Analysts

With the evolving landscape, certifications in data analytics and risk management will become increasingly valuable. Professionals may seek credentials such as the Certified Credit Professional (CCP) or certifications in data science to enhance their employability.

- Emerging certifications in data analytics and financial risk management

Salary Expectations and Growth Opportunities

The salary for Bilingual Credit Analysts is expected to rise significantly in 2026, reflecting the increased demand for skilled professionals in this niche. As financial institutions invest in technology and compliance, the complexity of the role will justify higher compensation packages.

- Projected salary growth driven by demand and skill scarcity

Visa and Career Stability for Bilingual Credit Analysts

The UAE's commitment to becoming a global financial hub ensures a stable job market for Bilingual Credit Analysts. The demand for bilingual professionals is expected to remain strong, providing job security and opportunities for career advancement.

- Continuous hiring trends in the finance sector

Top Employers Hiring Bilingual Credit Analysts in 2026

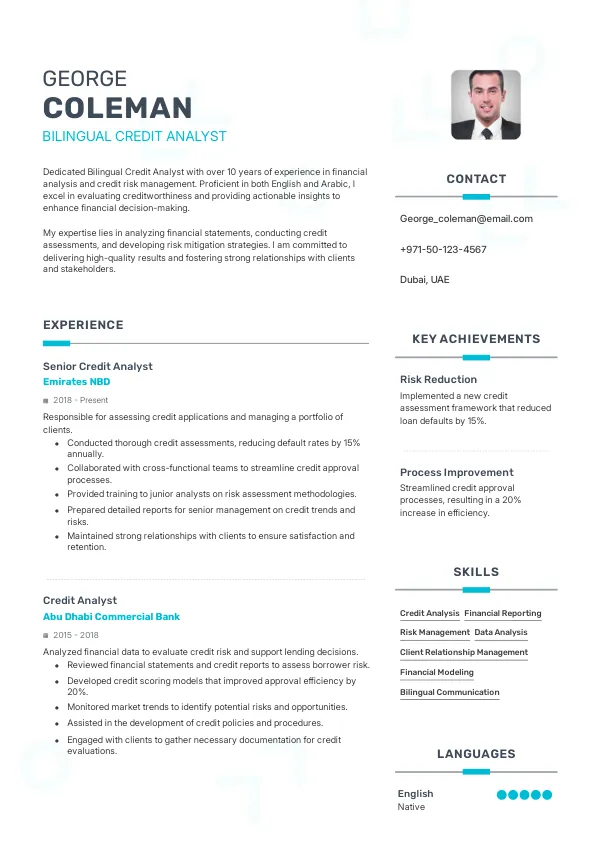

Leading financial institutions such as Emirates NBD, Abu Dhabi Commercial Bank, and Dubai Islamic Bank are actively seeking Bilingual Credit Analysts to enhance their teams. These employers recognize the value of bilingual professionals in navigating the diverse client landscape.

- Emirates NBD, Abu Dhabi Commercial Bank, Dubai Islamic Bank

Steps to Secure a Bilingual Credit Analyst Role

- Enhance your skills in data analytics and financial modeling.

- Align your resume with the specific requirements of the role using TrueCV.

- Develop a targeted application strategy focusing on top employers.

How TrueCV Enhances Your Job Search

- Tailored intake process to highlight relevant experiences.

- Mapping of keywords and expectations specific to the Bilingual Credit Analyst role.

- Continuous iteration and optimization of your resume for better visibility.

Resume Examples for Bilingual Credit Analysts

- Achievement: Successfully implemented AI-driven credit assessment tools, enhancing accuracy by 30%.

Frequently Asked Questions

What skills will be in demand for Bilingual Credit Analysts in 2026?

In 2026, skills in AI analytics, financial modeling, and bilingual communication will be crucial.

How is the job market for Bilingual Credit Analysts expected to change in 2026?

The job market is projected to grow due to increased digitalization and regulatory demands.

What certifications should I pursue to enhance my candidacy in 2026?

Consider certifications in data analytics and financial risk management to stand out.

What salary can I expect as a Bilingual Credit Analyst in 2026?

Salary expectations are rising, with competitive packages reflecting the role's complexity.

Which companies are hiring Bilingual Credit Analysts in 2026?

Top employers include Emirates NBD, Abu Dhabi Commercial Bank, and Dubai Islamic Bank.

Prepare for Your Future as a Bilingual Credit Analyst

As the finance industry evolves in 2026, ensure your resume reflects the latest skills and expectations. Leverage TrueCV to optimize your application and stand out in a competitive job market.